New Jersey Unemployment Wage Base 2024

New Jersey Unemployment Wage Base 2024. For calendar year 2024, the maximum unemployment insurance, temporary disability insurance and workers' compensation benefit rates, the alternative earnings and base week amounts, and the taxable wage. New jersey minimum wage law update.

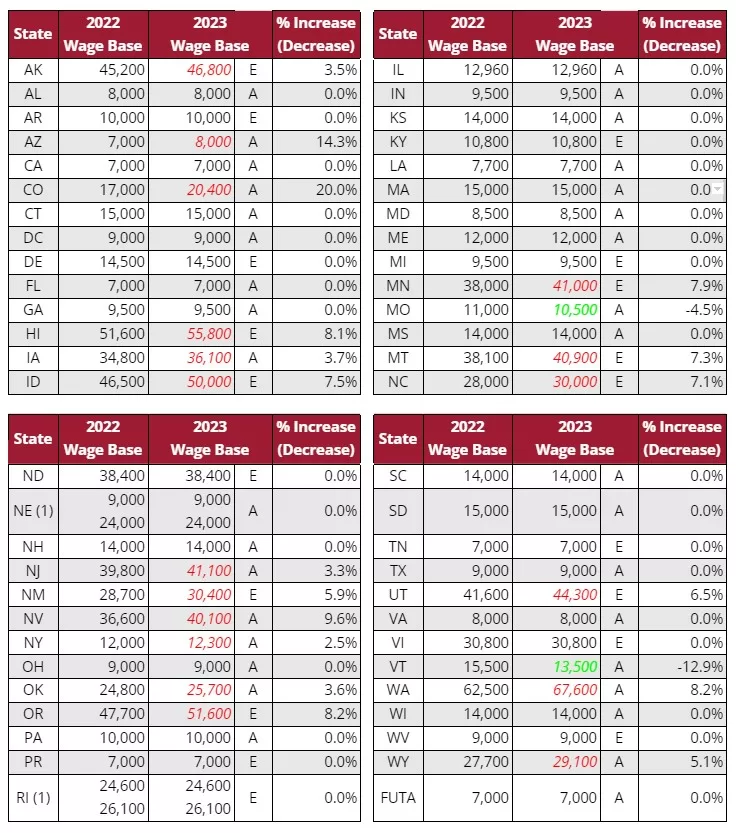

The taxable wage base for workers covered under the temporary disability and family leave insurance programs increased to $156,800 for 2023. States that have increased their wage base for 2024 are listed in bold and states with wage base decreases are in bold italic.

Employee Contribution Rate Includes The Workforce Development/Supplemental Workforce Funds Surcharge.

Several states have released their state unemployment insurance taxable wage bases for 2024 in a chart provided and updated by payo.

2024 State Unemployment Wage Base Limits And Rates.

The taxable wage base for workers covered under the temporary disability and family leave insurance programs increased to $156,800 for 2023.

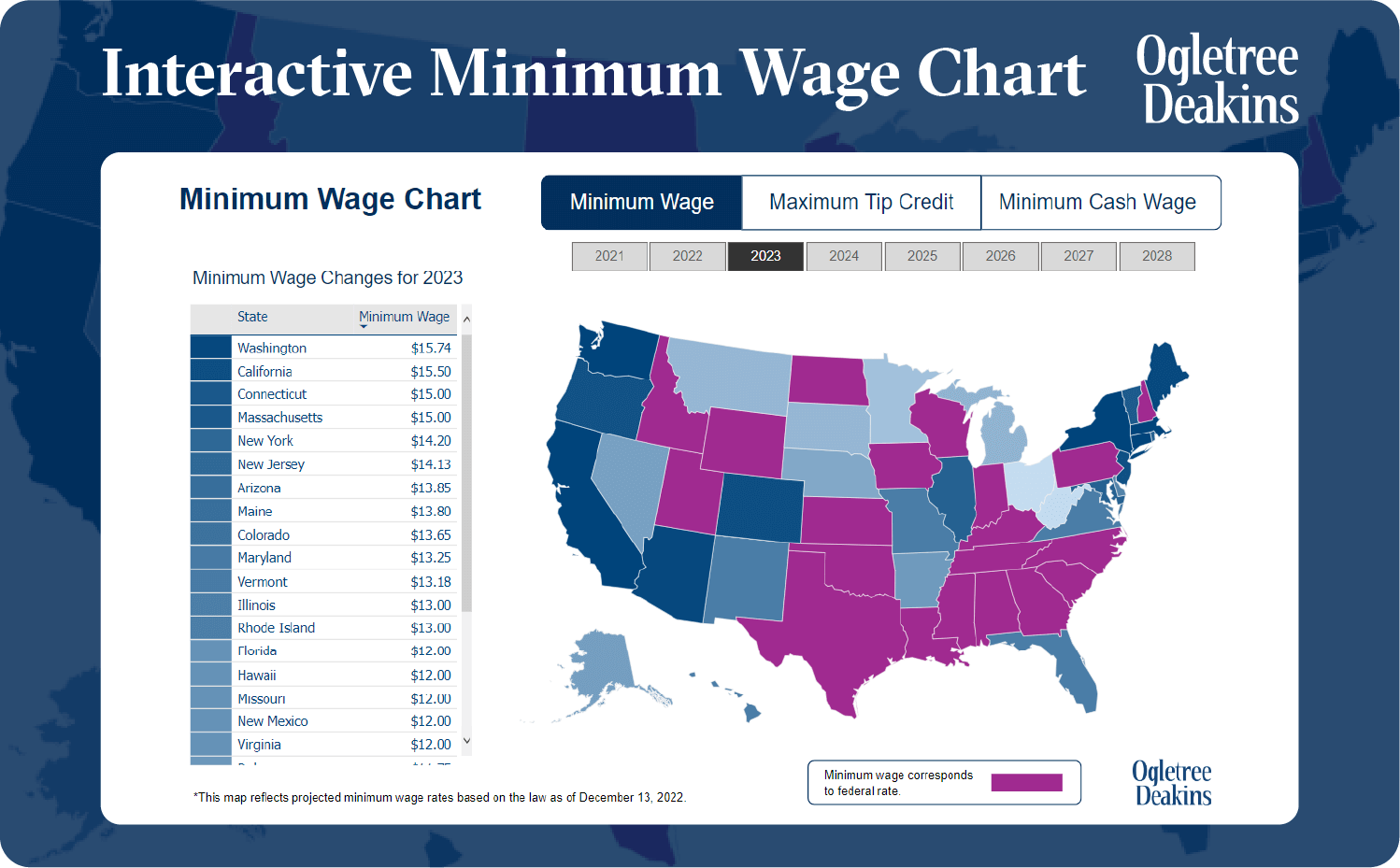

1, New Jersey’s Minimum Wage Will Rise By $1 And Reach Its Highest Level Ever, $15.13 An Hour, Thanks To A Law Passed By Democratic Lawmakers.

Images References :

Source: www.youtube.com

Source: www.youtube.com

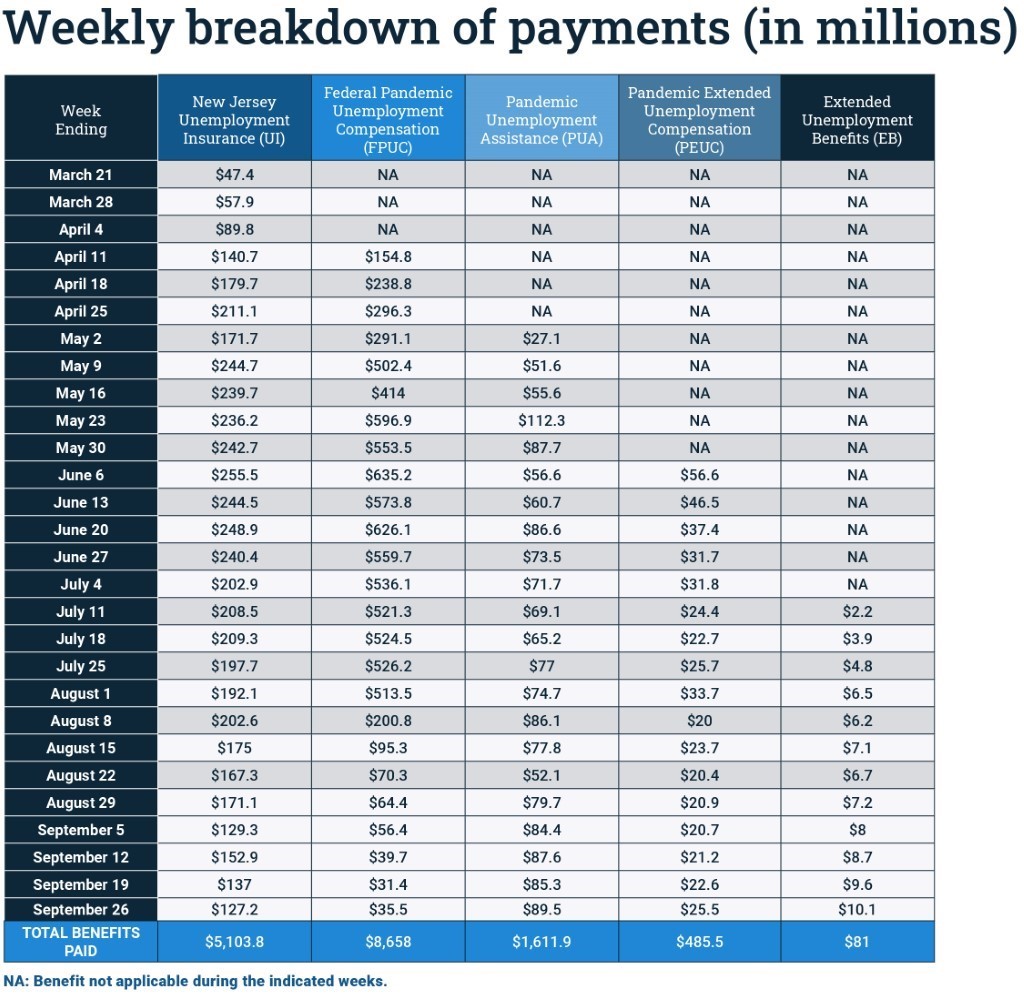

HOW TO FILE NEW JERSEY UNEMPLOYMENT YouTube, Updated april 2024 these free resources should not be taken as tax or. The maximum benefit rates and the taxable wage base are recalculated each year based on the statewide average weekly wage, under the laws governing these.

Source: www.insidernj.com

Source: www.insidernj.com

NJDOL NJ Unemployment Claims Rise for 2nd Straight Week, 2024 state unemployment wage base limits and rates. The taxable wage base for workers covered under the temporary disability and family leave insurance programs will increase to $151,900 for 2022.

Source: phillidawsuki.pages.dev

Source: phillidawsuki.pages.dev

Minimum Wage 2024 18 Year Old Dodi Yolane, Updated april 2024 these free resources should not be taken as tax or. New jersey fy 2024 suta rates range from 1.200% to 7.000%.

Source: autofreak.com

Source: autofreak.com

New Jersey Unemployment Insurance Guide. Auto Freak, States that have increased their wage base for 2024 are listed in bold and states with wage base decreases are in bold italic. The taxable wage base for workers covered under the temporary disability and family leave insurance programs increased to $156,800 for 2023.

Source: statescoop.com

Source: statescoop.com

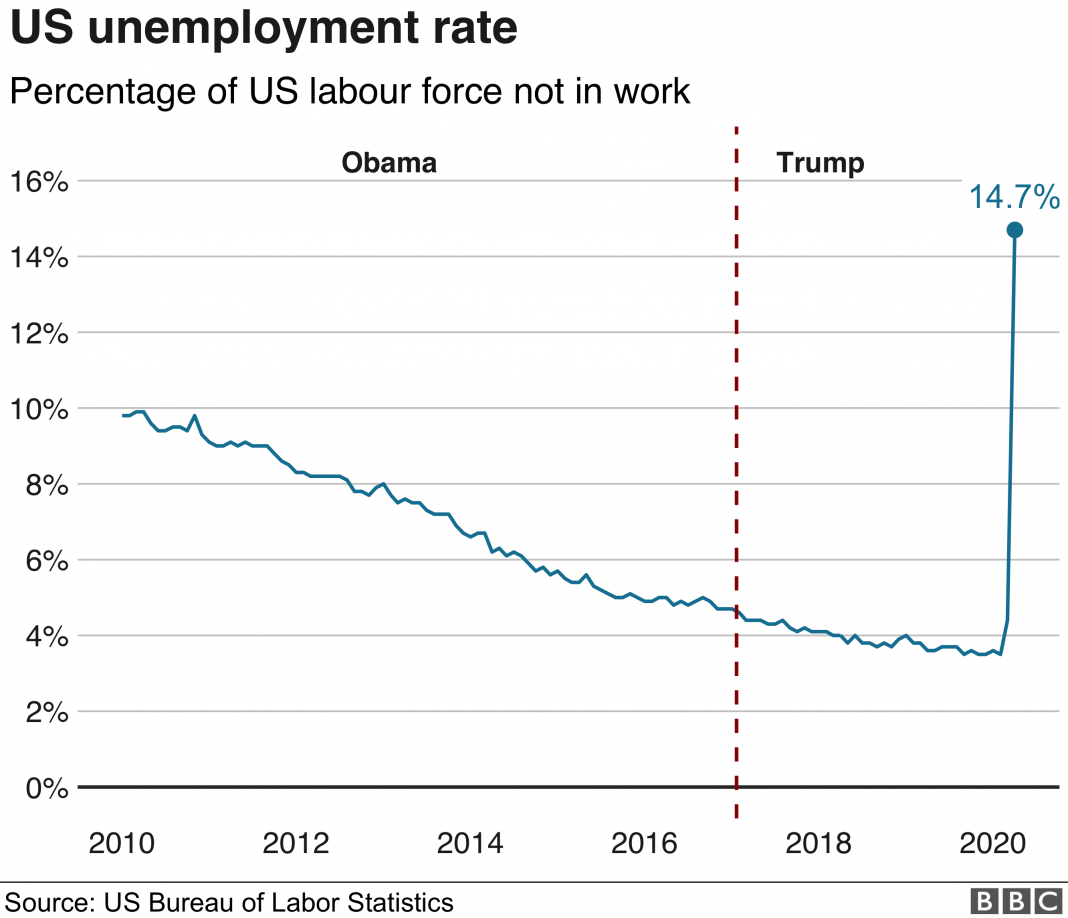

New Jersey’s unemployment system might get audited StateScoop, 2024 state unemployment wage base limits and rates. In 2024, sui levies are calculated using a taxable wage base of $42,300.

Source: www.aatrix.com

Source: www.aatrix.com

Annual Taxable Wage Bases For 2023 Aatrix, In 2024, sui levies are calculated using a taxable wage base of $42,300. New jersey fy 2024 suta rates range from 1.200% to 7.000%.

Source: www.schorrlaw.com

Source: www.schorrlaw.com

Will You Be Eligible for Unemployment in New Jersey?, Rates range from 1.2% to 7.0% and depend on the employer’s experience rating. 1, new jersey’s minimum wage will rise by $1 and reach its highest level ever, $15.13 an hour, thanks to a law passed by democratic lawmakers.

Source: www.newjerseyemploymentlawyersblog.com

Source: www.newjerseyemploymentlawyersblog.com

Unemployment Appeals Category Archives — New Jersey Employment Lawyers, To be eligible for unemployment insurance benefits in 2024, you must have earned at least $283 per week (a base week) during 20 or more weeks in covered employment. Employee contribution rate includes the workforce development/supplemental workforce funds surcharge.

Source: www.youtube.com

Source: www.youtube.com

New Jersey Unemployment Claims Climb 32, Breaking Previous Record, 1, 2021, new jersey’s unemployment taxable wage base will increase to $36,200, up. The unemployment tax rate for employees in 2024 is 0.425%;

Source: www.gardenstateinitiative.org

Source: www.gardenstateinitiative.org

New Jersey’s High Unemployment Rate Demands Use of Federal Aid, Not Tax, This is the maximum wage per. Base week amount $283 employers taxable wage base for tdi $42,300 workers taxable wage base for fli $161,400 worker contribution rate for fli 0.09% maximum yearly.

6.4% *Total For Ui And Workforce Development Partnership.

1, 2021, new jersey’s unemployment taxable wage base will increase to $36,200, up.

The Taxable Wage Base Increased From $41,100 To.

Rates range from 1.2% to 7.0% and depend on the employer’s experience rating.